Online Tax Sale Services

Online Tax Sale

VisualGov offers an online marketplace for investors to purchase Tax Certificates

Overview

Hosting

- Online Tax Sale is hosted in a world-class facility

- High capacity servers

- Redundant, high-bandwidth Internet connections

- Battery backup and diesel powered generators

- 24/7 operation with video surveillance and secure biometric access

Features

- Highly customizable to meet your specific needs

- Simple, straightfoward and easy to use for both staff and investors

- Guides investors through registration and deposits

- Flexible, multiple deposit payment options

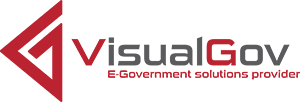

- Fully supports completing the W9 form

- Investor training available through webinars, practice website and online documents

- Parcel file downloads

- Bidding file uploads

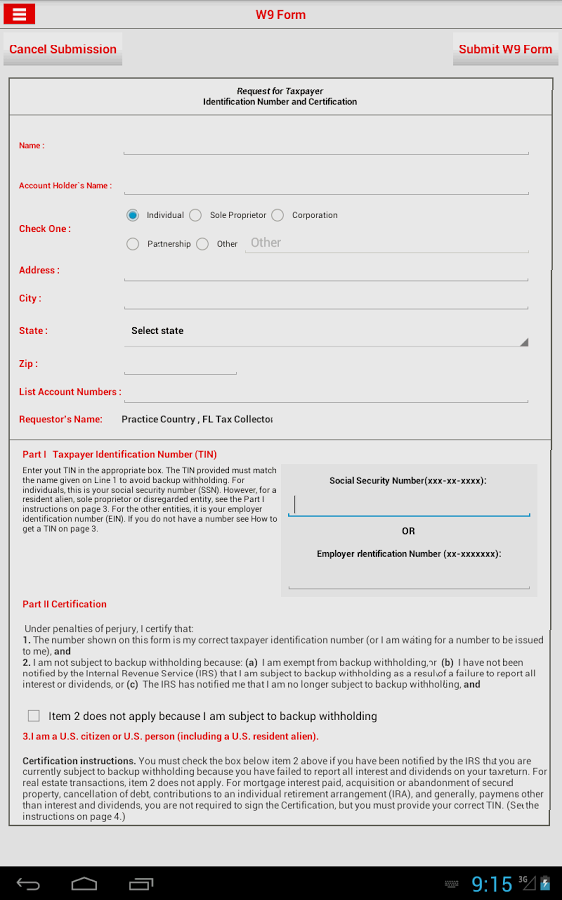

- Supports Apple/IOS and Android portable phones and tablets

- Dynamic parcel refresh allows bidders to re-allocate bids when taxes are paid

- Automatic awarding

- Customer service and Chat support for real-time assistance

Benefits

- Increases bidder participation and certificate sales

- More efficient than traditional sale methods

- Staff available to provide other services

- Adapts easily to policy or business practice changes

- Safe and secure

Sale Services

Real estate taxes provide the funding necessary for governments to perform the functions society deems important. When these taxes are left unpaid, it reduces the available funding for government services. Tax Certificates solve the funding shortfall by allowing investors to pay the back taxes in exchange for future interest payments or potential ownership.

Bidder Registration

Bidders register with each county to participate in Online Tax Sales. This ensures proper identification of each bidder along with accurate recording of initial funding deposits, which go towards satisfying the outstanding taxes. Additionally, bidders are required to complete the necessary IRS form W-9 for income taxes. The Online Tax Sale permits bidders to simultaneously register for multiple auctions, if desired.

- Bidders register to participate

- Complete W-9

- Deposit funds to allow bidding

- Register for multiple auctions simultaneously

Delinquent Parcels

Parcels with unpaid taxes are loaded into Online Tax Sale Service for investors to review and star bidding. Before the auction concludes, parcel owners have the opportunity to pay their delinquent taxes along with late fees. When this occurs, the properties are automatically removed from participating in the auction, which enables investors to bid on the remaining properties thereby maximizing the use of their available funds.

- Load properties with unpaid taxes

- Automatically remove parcels when delinquent taxes are paid

- Maximize investors use of funds

Bidding

Bidders review delinquent tax parcels and place interest rate bids or percentages on the desired properties. Participants have a set period of time to place bids before bidding closes and the winners awarded tax certificates. The lowest interest rate bid wins. Investors may download complete parcel lists to prepare bids offline, and upload the file to register their bids. A complete facility is provided.

- Place bids

- Download/upload parcel bidding files

- Export/Import to/from 3rd party software

- Lowest interest rate wins

Awarding

Auctions comprise a set period of time to bid on various properties. At a preassigned date and time, the auction concludes and the lowest interest rate bidder for each property is awarded a Tax Certificate. This entitles winners to future interest payments at the winning rate or optionally to file tax deeds.

- Bidding period is finite and closes at a predetermined time

- Tax certificates awarded to lowest bidders

- Investors can receive future interest payments or optionally file for a deed

Training

Investor training is available through traditional online self-help documentation, online webinars and practice websites. Although the Online Tax Sale application is very intuitive, sometimes formal training is practical to help establish a firm foundation for bidding

- Online documentation

- Interactive training webinars

- Practice websites